5355 West

Herriman Main Street

Herriman, UT 84096

- City Council

- Planning Commission

- City Administration

- Gov 101

- Property Tax

- Public Notices

- Ordinances and Code

- Police Department

- Community Services

- Animal Services

- City Services

- City Recorder

- Court

- Elections

- Building

- Communications

- Human Resources

- ITS

- Master Plans & Capital Facility Plans

- Engineering

- Finance

- Planning and Zoning

- Public Works

- Master Fee Schedule

- Transparency

- Hunting Information

Property Tax

Herriman Property Taxes

The City Council is tasked with representing residents in prioritizing City's services within the bounds of its financial means.

What Herriman property tax is increasing next year?

The Herriman City Council controls three separate property tax entities that pay for different types of services. The Herriman City Safety Enforcement Area (HCSEA), which funds police/law enforcement services in Herriman; the Herriman City Fire Service Area (HCFSA), which funds fire and emergency medical services; and Herriman City, which funds a small portion of all other City services. None of these entities had a tax increase.

Doesn’t the City already get more property tax revenue when it grows?

Yes and no. Utah state property tax law is set up in a way that taxing entities (cities, counties, etc.) receive the same amount of revenue year to year regardless of property values rising or falling. Each year, the State uses property value data and tax revenue targets to calculate tax rates so that, on average, residents don’t pay a different dollar amount year to year. If property values rise, the tax rate decreases. The overall revenue that the city receives stays the same, except when there is new growth (which regularly occurs in Herriman). When there’s new growth, the new homes are taxed at the same rate as existing homes, so revenue increases alongside the growth. But the rate stays the same.

However, if a taxing entity needs more revenue than population growth is providing, they can choose to raise the property tax rate in order to reach a higher revenue amount.

For a deeper explanation, see “how are property tax rates set in Utah?” below.

Who/what do I pay property taxes to?

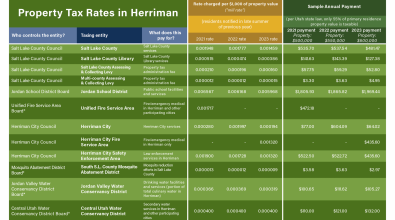

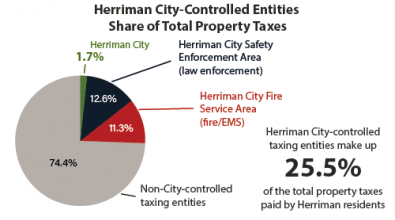

Some may wonder if their property taxes just go to their local city and nowhere else. The answer is no. In Herriman, the general City tax itself represents only a small portion—about 1.7% this year—of the total amount paid. Law enforcement and fire service taxes each add an additional 11.3-12.6%. So, all three City-controlled entities add up to about one quarter of the total property tax paid. So where does the rest of it go?

Several different entities have the authority to levy property taxes. For Herriman residents, this includes the Jordan School District, Salt Lake County, Herriman City and its related entities (law enforcement and fire), the Jordan Valley and Central Utah Water Conservancy Districts, and the South Valley Sewer District.

To the right is an overview graphic that shows what entities charge property taxes, who controls the entities, what the funds pay for, and a sample annual payment. Click on it for a larger view. Entities proposing a tax increase for 2024 are highlighted in yellow. The exception is the Salt Lake County Library, which has already approved its increased rate.

How are Herriman property taxes spent?

The Herriman City Safety Enforcement Area (HCSEA) funds police/law enforcement services in Herriman. The Herriman City Fire Service Area (HCFSA) funds fire and emergency medical services. And Herriman City funds a small portion of all other City services.View the budget here.

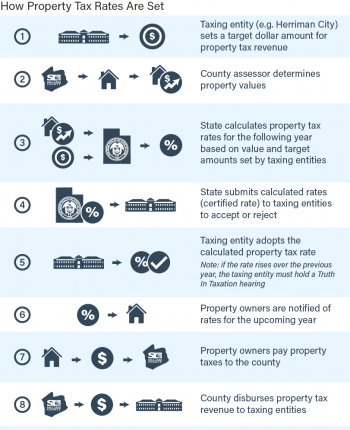

How are property tax rates set in Utah?

The state of Utah is somewhat unique in how it sets property tax rates. In many states, property taxes are a simple percentage, and the amount paid every year is directly tied to how much properties are worth—if property values go up, then taxes paid go up. In Utah, however, taxes are designed to stay the same year to year, regardless if property values go up or down. How does it work?

Certified Rates

Taxing authorities submit a property tax revenue target to the State of Utah. County Assessors determine individual property values. The State uses the revenue target and the general trend of property values (information provided by counties) to calculate the appropriate rate to charge in taxes to achieve the target revenue during the year. This State-calculated rate is called the certified rate. Since property values change each year (usually increasing), tax rates are re-calculated every year. In a normal year, as long as a taxing authority doesn’t change their target revenue, the certified rate will stay the same or decrease from the previous year to offset rising property values. However, if a taxing authority wants to increase their target revenue, it will likely cause the State’s calculated certified rate to be higher than the previous year. If the rate is higher, then official notices must be mailed to residents and the taxing authority must hold a public Truth-in-Taxation hearing.

Once the final rate has been approved, property taxes will be paid during the following calendar year. For efficiency, taxes are paid to one central entity, the county. The county then disburses the tax revenue to the various taxing authorities throughout the year based on their rates. Those taxing entities and their governing boards may then expend the money based on their approved budgets.